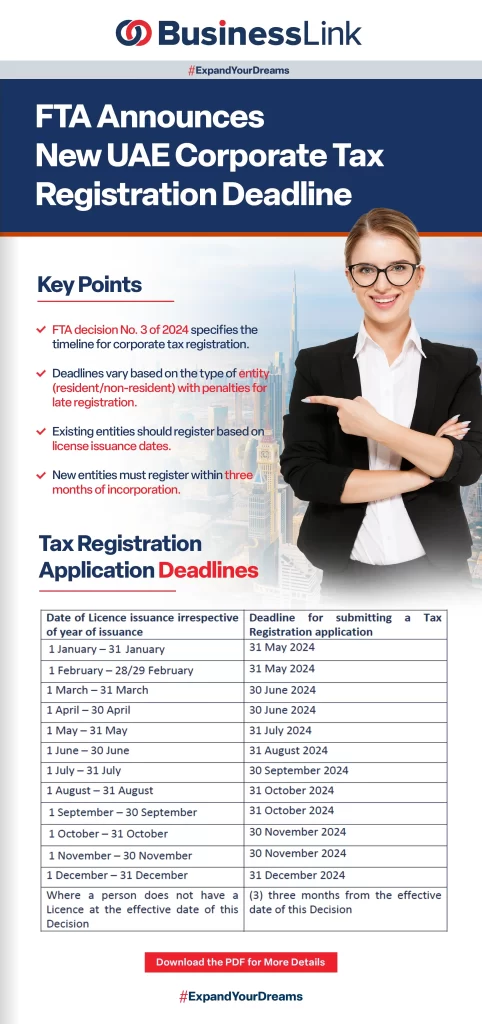

The Federal Tax Authority has issued Decision No. 3 of 2024, which will be effective from 1 March 2024. The decision specifies the timeline for the registration of taxable persons for corporate tax purposes.

Key Points from the Decision:

- Registration Deadlines for Resident Juridical Persons:

- Existing juridical persons must submit their tax registration applications based on the date of license issuance, with deadlines ranging from 31 May 2024 to 31 December 2024.

- New juridical persons must submit their applications within three months from the date of incorporation, establishment, or recognition.

- Registration Deadlines for Non-Resident Juridical Persons:

- Non-resident persons with a permanent establishment in the UAE must register within nine months from the date of existence of the establishment.

- Non-resident persons with a nexus in the UAE must register within three months from the effective date of the Decision or the date of establishment of the nexus.

- Registration Deadline for Natural Persons: Natural persons conducting business in the UAE must register by 31 March of the subsequent Gregorian calendar year if their total turnover exceeds the specified threshold.

- Late Registration: Administrative penalties of AED 10,000 will apply to entities failing to register within the specified timelines

Please review the complete Decision for detailed information on the registration process and deadlines.

We value your dedication to maintaining your business’s compliance. Initiating the process of corporate tax registration is important.

Business Link experts are committed to supporting you every step of the way.

For any assistance or clarification regarding tax registration, please feel free to contact our team.

Tell: +971 50 205 2735