The General Authority for Investment and Free Zones (GAFI), which is primarily in charge of managing free zones in Egypt, has a well-established system in place. Creating a free zone in Egypt, a nation known for its extensive history and vibrant culture, is also advancing its economic growth. The various zones across the nation focus on a wide variety of different industries. By establishing new special economic zones in accordance with the Special Economic Zones. Law No. 83 of 2002, Egypt expanded the number of investment opportunities available. To explore the Special Economic Zones (SEZs) of Egypt’s unrealized potential, we are starting an exciting journey today. Prepare yourself to discover a wealth of growth opportunities in the land of pharaohs and pyramids as we delve into the complexities of business setup in Egypt and free zones.

Setting the Scene: Freezone in Egypt

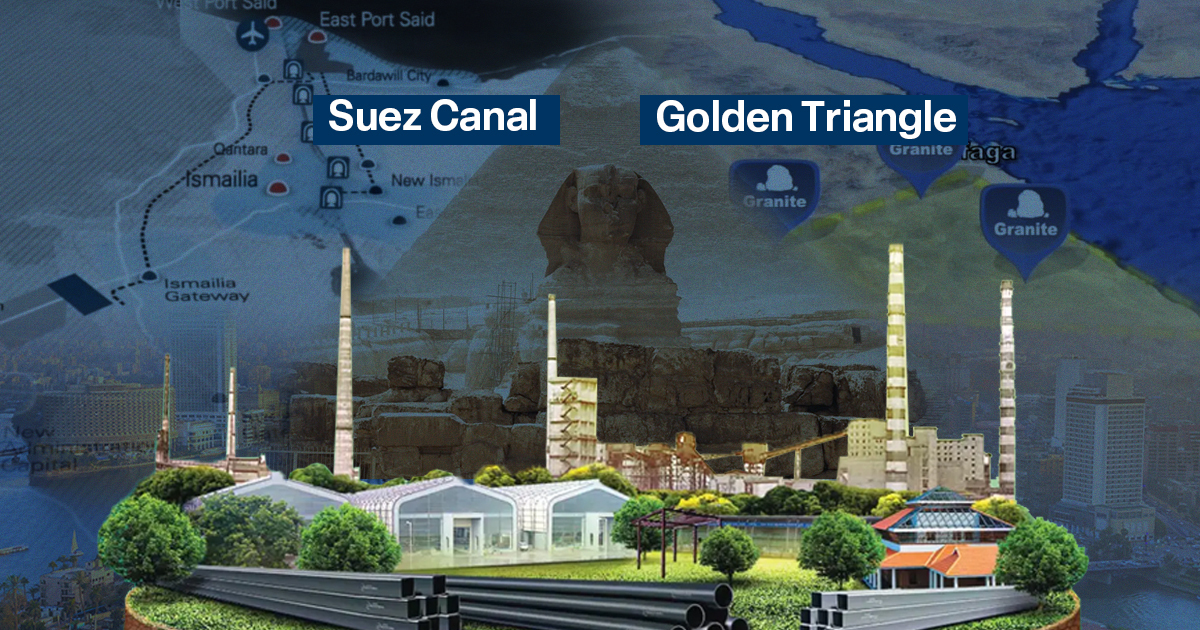

The SEZ Law is built around the idea of a one-stop shop and stipulates the creation of a single governing body (the Economic Zone Authority) to manage investment-related issues within each zone. This organization is qualified to carry out all governmental directives and issue necessary licenses. It removes limitations on foreign ownership and offers simplified tax and customs systems. Also, the law also specifies effective frameworks for resolving disputes and efficient licensing procedures. There are now two prominent zones in operation: the Suez Canal Special Economic Zone (SCZone) and the Golden Triangle Economic Zone (GTZone).

The Suez Canal Special Economic Zone (SCZone):

Established in 2015, this economic zone holds a strategic position as a gateway between Asia, Africa, and Europe. With its proximity to the Suez Canal, one of the world’s busiest shipping lanes, the SCZone presents immense opportunities for trade. Also, the zone covers an area of approximately 461 square kilometers, spanning three governorates: Port Said, Ismailia, and Suez.

The Golden Triangle Economic Zone (GTZone):

Established in late 2017, the Golden Triangle Economic Zone (GTZone) is located on the northwest coast of Egypt. Covering an area of approximately 160 square kilometers, the zone is strategically positioned near Alexandria and the Mediterranean Sea. Additionally, the GTZone aims to capitalize on its location to promote investment, boost exports, and drive economic growth.

Business Setup in Egypt:

Egypt’s Special Economic Zones (SEZs) give entrepreneurs an ideal opportunity to launch their ventures in a strategically advantageous location. Starting up a company in another country may seem like a difficult task, but have no fear! A clear path to success is offered by Egypt’s free zones. Let’s look at the crucial steps to building your business empire amidst the wonders of Egypt, from research and planning to legalities and logistics.

- Strategic Location: Visualize yourself at the intersection of the three continents—Africa, Europe, and Asia. Egypt is now a gateway for international trade due to its advantageous location, which gives companies unmatched access to local and global markets.

- Excellent Workforce: Egypt has a large, skilled workforce that is prepared to support your entrepreneurial endeavors. Draw from a talent pool of experts who combine a passion for innovation with tradition.

- Beneficial Investment Climate: Egypt’s dedication to economic reforms and investor-welcoming policies have produced a positive investment environment. The ease of doing business in Egypt’s SEZs has never been greater thanks to streamlined procedures and incentives like tax exemptions, customs benefits, and streamlined bureaucracy.

- Legal and Administrative Procedures: Every entrepreneurial journey involves stumbling through the bureaucratic and legal maze. Understanding the legal requirements, licensing procedures, and administrative processes is essential when it comes to business setup in Egypt. To ensure a simple and trouble-free setup that will free you up to concentrate on what you do best—building your business empire—seek professional advice and services.

Utilizing Free Zones in Egypt to Their Full Potential:

- Tax advantages: Who doesn’t enjoy tax advantages? Free zones in Egypt provide a haven for companies looking for a hospitable financial environment. Enjoy tax breaks, reduced duties, and streamlined customs procedures to give your business the competitive edge it needs.

- Infrastructure and Connectivity: The top-notch infrastructure and connectivity found within Egypt’s free zones will astound you. These zones have modern transportation networks and cutting-edge logistics facilities that are intended to support the expansion of your business.

- Market Access: Free zones in Egypt serve as vital entry points into local and international markets. It provides access to tariff-free markets, preferential trade agreements, and strategic locations near major shipping lanes.

You have seen the key features of Egypt’s Special Economic Zones, where there are numerous chances to establish a business. Unravel the secrets of business setup in Egypt with its ancient wonders and modern marvels. Egypt’s Special Economic Zones (SEZs) provide a playground for driven entrepreneurs, thanks to their strategic advantages, vibrant ecosystem, and irresistible incentives. In Egypt’s business landscape, you should therefore muster your courage, ignite your entrepreneurial spirit, and forge ahead.

To be precise, investing in these prominent economic zones is more than just a financial decision. It is a strategic move toward unlocking infinite potential, leveraging the power of global trade, and reaping the benefits of Egypt’s economic resurgence.